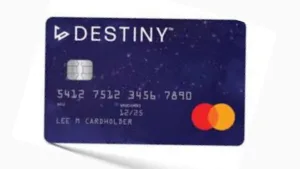

Destiny Credit Card: In the vast landscape of financial tools, credit cards have become an integral part of everyday life. Among the myriad options available, the Destiny Credit Card stands out as a unique offering, promising a blend of benefits and features tailored to meet the diverse needs of consumers. In this article, we will explore everything you need to know about the Destiny Credit Card.

What is the Destiny Credit Card?

The Destiny Credit Card is a financial product designed to provide users with a convenient and flexible means of making purchases, both online and offline. It is typically issued by banks or financial institutions and carries the logo of major credit card networks such as Visa, Mastercard, or American Express. The card comes with a predetermined credit limit, allowing users to make purchases up to that limit.

Features and Benefits

1. Credit Limit and APR:

One of the key aspects of the Destiny Credit Card is the credit limit, which represents the maximum amount users can borrow. This limit is determined based on factors such as the individual’s creditworthiness and financial history. Additionally, the card comes with an Annual Percentage Rate (APR), which is the interest rate applied to outstanding balances if not paid in full by the due date.

2. Rewards Program

Many Destiny Credit Cards come equipped with a rewards program, offering users the opportunity to earn points, cash back, or other benefits for every dollar spent. These rewards can often be redeemed for travel, merchandise, or statement credits, providing an extra incentive for cardholders to use their Destiny Credit Card for various transactions.

3. Introductory Offers:

To attract new customers, Destiny Credit Cards often come with introductory offers, such as a 0% APR for a specified period or bonus rewards for the initial months. These perks can be particularly appealing for individuals looking to make significant purchases or transfer existing balances from other credit cards.

4. Security Features

Destiny Credit Cards ‘ financial information. They usually incorporate features such as EMV chips, which provide an additional layer of protection against fraud, and zero-liability policies, ensuring that users are not held responsible for unauthorized transactions.

5. Fees and Charges:

It is crucial for users to be aware of the fees associated with the Destiny Credit Card. Common fees include annual fees, late payment fees, and cash advance fees. Understanding these charges can help users make informed decisions and manage their finances more effectively.

How to Apply

Applying for a Destiny Credit Card is a straightforward process. Individuals can typically apply online through the issuing bank’s website or in person at a branch. The application process involves providing personal and financial information, and approval is contingent on factors such as credit score, income, and debt-to-income ratio.

Responsible Credit Card Usage

While the offers numerous benefits, it is essential for users to practice responsible credit card usage. This includes paying bills on time, staying within the credit limit, and being mindful of the impact on one’s credit score. Responsible use can lead to improved creditworthiness and open the door to better financial opportunities in the future.

The Destiny Credit Card is a versatile financial tool that can empower individuals with the flexibility to make purchases, earn rewards, and build credit. By understanding its features, benefits, and associated responsibilities, users can make informed decisions about whether the aligns with their financial goals. As with any financial product, careful consideration and responsible usage are key to maximizing the benefits and minimizing potential pitfalls.

WRITTEN BY COLLINS